As health technology increase so does the likelihood that individuals will live longer. Economic factors also effect the total cost of health insurance for individuals and families, and this cost have been steadily increasing. Health issues based on age factors or incidents also affect health insurance costs. Moreover, a combination of individual circumstances, age and socioeconomic issues all affect the cost of health care. With unemployment on the rise, how will individuals continue to afford health insurance? Even when employment is not an issue, things such as rent, food, utilities and child care must be paid as well. Even then, the affordability of health insurance is still a huge issue for minimum wage earners and medium paying jobs. So, how much will any individuals have to pay for health insurance? There are several factors that continue to effect the cost of individual health insurance.

Premiums and Health Insurance Costs

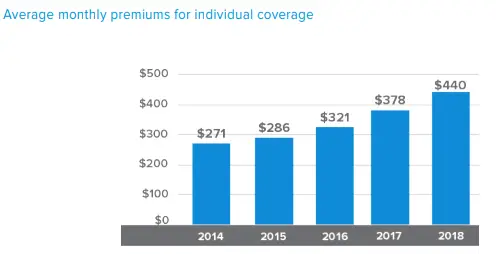

The general cost of individual health care policies is always affected by socioeconomic factors. As of 2011, the average individual cost for health insurance was slightly more than $182 per month, or almost $2200 per year for basic health insurance coverage. These averages are based off of an ehealth insurance report provided by the Cost & Benefits of Individual and Family Health Insurance Plans 2011. According to the report, family insurance policies were more than double the cost of individual policies with an average of almost $415 per month for premium costs.

Health Insurance Cost and Out-of-Pocket Expenses

Out-of-pocket expenses for health insurance can be just as high as regular premium costs on a monthly basis, and in many cases these costs can be much higher. Individuals are responsible for everything else that their health insurance policy doesn’t cover, including deductibles, copayments, coinsurance portions and more. These expenses can often be a huge strain on an individual or family budget. However, individuals with out-of-pocket expenses paid by an employment based health insurance policy, may see some saving based on fixed amounts of copayments, prescription drug costs and other costs like deductibles. Even so, those that are enlisting health insurance providers on their own, usually have to find policies with fixed amounts of out-of-pocket expenses or face possible health-budget busters as they go along.

Deductible Health Insurance Costs

Deductibles are an unfortunate must for individual and family health plans. Deductibles must be paid for before an insurance company will make good on their health plan. Even if an insurance holder has been paying for health coverage for almost one year, and suddenly needs to use their health insurance coverage, they must pay for the deductible before the remaining expenses are paid for by the insurance company. This can be troublesome for individuals that are on a fixed income and often cannot afford the additional expense of a deductible, especially after they can barely afford to pay for the monthly health insurance premiums. On top of the yearly premium costs, Cost & Benefits of Individual and Family Health Insurance Plans 2011 stated that the average cost for deductibles was almost $800 more than the total cost of premiums for the year. This means that individuals have to pay out almost $3000 in additional deductible costs, before they can expect their insurance company to pay for their agreed upon health care expenses.

Copayments and Coinsurance

Even after required deductible costs, some health insurance plans still require an individual to pay for part of the cost of their health expenses. These expenses are also known as coinsurance costs. This includes paying for preventative services, routine checkups and other elective and emergency procedures. What does the average American pay for coinsurance expenses? While insurance policies will usually cover about 80% of health related expenses, the individual is still responsible for the remaining 20%. Furthermore, copayments is yet another expense that is tacked onto health insurance policies and is closely related to coinsurance costs. Copayment costs are an addition cost the health insurance policy holders must pay for certain elected procedures. These expenses are usually plainly stated within each policy manual. For instance, Sharon may have to pay a flat fee or $10,000 to get her tubes tide directly after giving birth. These flat fee services must be paid ahead of time before any procedures are begun.

State to State and Health Coverage

Although the average cost of health insurance is less than $200 per month, this does compare to some of the averages on a state by state basis. For instance, on average New York policy holders pay slight more than $15,070 for health insurance with employment coverage. This averages to more than $1200 per month for individual coverage. This is a huge discrepancy between the national average for health insurance cost. So, most of the time the average amount of health insurance cost for both individuals and families is highly linked to the economic status of each state. Furthermore, the yearly increase of average policy amounts is also based a state by state economic basis.