If you take two people with the exact same income, one may be able to afford a much larger mortgage than the other can depending on the area each individual lives in and their monthly bills and expenses. Determining how much mortgage you can afford without factoring in what a bank will actually lend you is one of the best ways to make your financial future more secure.

Current Debt

Before even thinking about taking on any new debt, you should always add up your current debt. Start with your fixed payments, adding them up for a monthly total. Fixed debt expenses may include:

- Personal loans

- Student loans

- Auto loans

Once you know what your fixed debt payments are each month, add up your revolving payments based on the worst case scenario. Revolving debt generally includes:

- Credit cards

- Lines of credit

When making this calculation, it is best to determine how much your monthly payments would be if each credit card or line of credit were maxed out. This will help you determine whether or not you could still afford your monthly debt payments in the worst possible case, whether or not it would ever reach that point.

Utilities

The amount you will need to pay in utilities will vary drastically depending on what area you live in and the type of house you want to buy. If you are planning to purchase a home in the area you already live in, you can typically use your current utility bills as a guideline. Keep in mind that even if you are staying in the same area, water rates may vary by county or town, and your current television, home phone, or power company may not service the area you move to. If you are moving to another town or state, researching the utility rates in the area can be beneficial: they may be significantly higher or lower than what you are currently paying. In general, you will want to add up the following bills:

- Water

- Electric

- Gas

- Trash pickup

- Television (optional)

- Home phone (optional)

Expenses

Determining monthly expenses can be tricky for many people, especially if they do not follow a strict budget. These costs tend to fluctuate every month; therefore, it is best to estimate high to give yourself some breathing room when it comes to determining how much mortgage you can afford. Again, keep in mind that these estimates may change from what you are currently paying depending on what area you are planning to buy in; this is especially true in regard to transportation costs and groceries. Things to factor in include:

- Transportation expenses (gas, maintenance, public transportation)

- Groceries

- Household items

- Personal care

- Pet care

- Clothing

- Entertainment

- Savings

Adding Everything Up

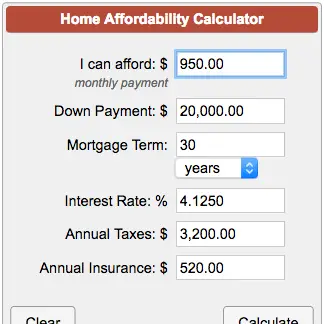

After you have determined your debt payments, fixed expenses and flexible expenses, add everything together using the highest number for each (for example, your electric bill will likely be highest in the summer). This total number is how much you spend, outside of housing, to live each month.

Salary

Your salary, and whether or not you are purchasing the home alone or with another person, is often the deciding factor when determining how much mortgage you can afford. The easiest thing to do is to take your monthly take-home pay (after taxes, insurance and other benefits are deducted) and subtract your current estimated monthly expenses from this number.

If you are basing your housing costs off of two incomes, it can be helpful to see what you can afford on the smaller of the two salaries. For example, if one person makes $80,000 a year and the other makes $60,000, see what you can afford if you only have the $60,000. Planning ahead for potential bumps in the road, such as job loss, is important when deciding how much mortgage you can afford.

The amount left over after you deduct your total monthly expenses from your total take-home pay can generally go towards housing costs; however, this does not just include your mortgage.

Housing Expenses

Although many people think that the mortgage is the only thing left after all of their monthly expenses are deducted from their salary, this is not true. Unlike renting, homeowners are responsible for every single repair, and not having enough expendable income each month to handle any unexpected damages can leave most families in a serious bind.

Generally, experts recommend that you set aside one to three percent of the home’s worth each year for repairs. For example, if you buy a home for $250,000, you should plan to set aside $2,500 to $7,500 each year for repairs, which is about $200 to $625 each month. Add this amount to your yearly property taxes, insurance and mortgage payments to determine your total housing costs.